Reposted from @tamikadmallory The post of the century!!!!!! @rudolphmckissick I’m laughing and cryin

Reposted from @tamikadmallory The post of the century!!!!!! @rudolphmckissick I’m laughing and crying at the same time! 🤣😩🤣😩#VOTEGEORGIA #VOTE

Reposted from @tamikadmallory The post of the century!!!!!! @rudolphmckissick I’m laughing and crying at the same time! 🤣😩🤣😩#VOTEGEORGIA #VOTE

The game will be held at Georgia State’s Center Parc Stadium in downtown Atlanta located at 755 Hank Aaron Dr SE, Atlanta, GA 30315. Purchase your tickets to support our Panthers here: https://txtf.co/xuzd8t

#SouthFulton #LangstonHughesHigh #StateChampionship #Georgia #GA #Football

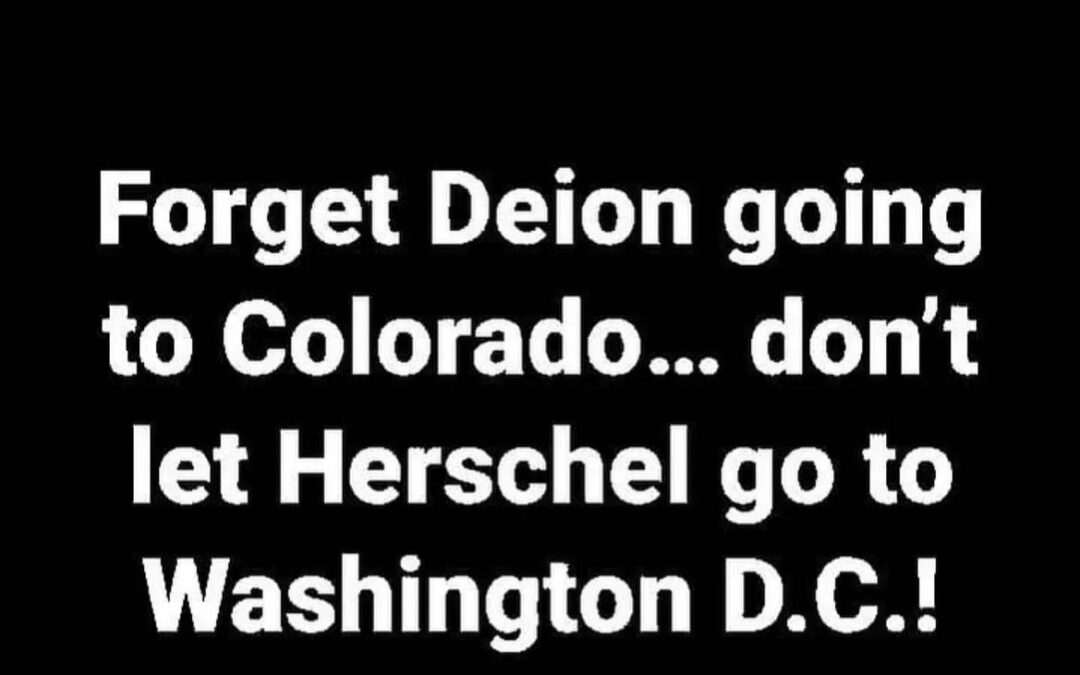

@raphaelwarnock @killermike @dnice @israelhoughton

Shop Talk

Monday, Dec 5th

The SWAG SHOP

2pm

#VoteWarnock

Reposted from @vanityfair On top of not believing in evolution, admitting he nearly killed his wife, and his own campaign staff calling him a “pathological liar,” Herschel Walker just gave the people of Georgia yet another reason not to vote for him. Read the latest update from @bess_levin at the link in bio.

@nbcblk Three years ago, Rhonda Terrell was diagnosed with an aggressive form of uterine cancer that has since spread to her abdomen and liver. She underwent a radical hysterectomy and tried to come to terms with the way the disease had altered her life.

Terrell is one of four Black women, three of whom spoke to @NBCNews exclusively, who have filed federal lawsuits against L’Oréal and other companies, alleging that chemicals in the companies’ hair products caused them to develop uterine cancer or other severe health effects.

The lawsuits follow the release last month of a study by the National Institutes of Health that found that women who reported frequent use of hair straightening products — defined as more than four times in the previous year — were more than twice as likely to develop uterine cancer compared to those who did not use the products.

Full story at the link at @lnweatherspoon / @NBCNews

#ArringtonPhillips #LegalNews #Attorneys #LegalNews #LawyerLife #BlackAttorney #Representation #BlackProfessionals #EntertainmentAttorney #BusinessLawyer #Lawyers #BlackandBarred #Lawyersofinstagram #Legal #Law #BlackEntrepreneur #BusinessAttorney #Contracts #BlackOwnedBusiness #BlackLawyersMatter #LawyersForCreatives #Suits #Entrepreneur #BlackLawyers

Written by Denise

Every now and then, an HOA board conflict will arise. When that happens, what should the HOA management company do? Should the company even intervene in the first place?

Reasons an HOA Board Conflict May Arise

HOA board members are not immune to conflict. Just as neighbors can have disputes, board members can also fight among themselves. Conflicts are not uncommon in an HOA setting — or any other setting where there are leaders. When it comes to homeowners associations, though, conflicts can arise because of several reasons.

First, and perhaps the most common reason, board members can disagree on business matters. Board members can have differing opinions on how to handle certain issues. A board member may not like the way others vote on an issue, resulting in harsh words or feelings.

This type of situation can devolve and plant negativity in that board member’s mind. What they view as an unfavorable outcome of a vote may cause them to harbor a personal vendetta against other members. So, the next time another vote takes place, they might intentionally vote the other way out of spite. This is particularly dangerous because board members have a fiduciary duty to make decisions that are in the best interest of the community. When they stray from this, they breach that fiduciary duty.

Sometimes, this personal vendetta might be aimed at a homeowner instead of a board member. This often results in the board member actively seeking ways to punish or penalize that homeowner. Other board members may take notice, leading to a confrontation.

And then there are new board members who are just eager to make changes in the community. While their intentions may be pure, their actions may come across differently. When a new board member suggests reforms, older board members tend to act defensively because they view it as a critique of the way they’ve been doing things.

The Importance of HOA Board Conflict Resolution

Disagreements are a natural part of leading a community. But, when HOA board members fight, it is imperative to resolve the conflict as soon as possible. Prolonged conflicts send a bad message to homeowners. These conflicts depict a divided board — one that can’t agree on anything. As a result, homeowners lose their trust in the very leaders they elected.

In addition to this loss of trust, conflicts also prevent a board from doing its job properly. Because of differing viewpoints or just plain personal rivalry, board members can’t make unanimous decisions or act as a single unit. More often than not, it is the homeowners and the general community that suffers. When homeowners have had enough, they will take action and start removing board members.

How to Resolve an HOA Board Conflict

When faced with a conflict, it is best that HOA boards handle things internally and privately first. Keep things professional and respectful. Dressing down the problem board member in public may only trigger them to lash out further.

Fellow board members should keep the following pointers in mind:

Remain objective. There is no use in getting angry, too. Maintain a calm demeanor and examine the situation objectively. Board members who emotionally detach themselves from the conflict are better suited to resolve it.

Find the root cause. The next step is to get down to the root cause of the conflict. Board members should listen to all sides of the story to arrive at a compromise or resolution. While it is important not to get emotionally involved, expressing sympathy will help calm the situation.

Stand firm. Sometimes, even when board members try their hardest, an angry board member simply won’t cooperate. They might try to shift the blame or justify their own actions. When this happens, board members should remain steadfast in their decision.

Most of the time, board members can resolve the conflict by talking things out. But, there are cases when the problem board member/s just won’t listen. When that happens, other board members have the option of asking that person to step down from their position . Keep in mind that board members don’t have the power to demand or force the resignation.

While removing a board member is possible, it usually requires a vote from the membership. For instance, for Tennessee condominiums, Section 66-27-403(f) of the Condominium Act of 2008 requires a two-thirds vote from unit owners present at a meeting where there is a quorum. Similar or differing provisions may exist within the governing documents of an association, though.

What Can an HOA Management Company Do?

Homeowners associations are managed by a set of directors and officers known as the HOA board. This board is responsible for the community’s operations, which involve preparing the budget, collecting dues , maintaining common areas, hiring and coordinating with vendors, and communicating with homeowners. Sometimes, an HOA board will hire an HOA management company to help carry out the day-to-day and administrative tasks necessary to keep the community functioning.

But, does an HOA management company have the right to intervene when conflict arises among board members? Typically, it does not have to come to that. Board members usually take action first before the company has to step in. The board members themselves are, after all, normally good at policing that type of thing.

It is important to remember that the role of the HOA management company is to provide advice, implement the board’s decisions, and oversee day-to-day operations. Thus, the company should not get too involved in the conflict. What the company can do, though, is gently advise the other board members to take action. Let them know that failing to resolve the conflict will only interfere with the operations of the community.

Furthermore, an HOA management company can assist with mediation. The community manager should not take it upon themself to mediate the dispute. Rather, it is best to hire a third-party neutral , with the manager or company simply offering assistance.

A United Board

Every association should try to avoid an HOA board conflict. But, in the event that a conflict does arise, board members should know how to deal with it. This way, the community can function seamlessly with a unified board at the helm.

Clark Simson Miller provides expert HOA management services to homeowners associations and condominium communities. Call us today at 865.315.7505 or contact us online to get a free proposal.

The post HOA Board Conflict: Can An HOA Management Company Intervene? appeared first on Clark Simson Miller.

Shared from Clark Simmon Miller

You have to believe in yourself in order to win. 🎥 @official7figuresquad

#Texas #Arizona anywhere but #Georgia

Reposted from @mikeluckovich.

Written by Lawyer Monthly

For many, it’s a common misconception that estate planning is only for the wealthy. However, it may be time to change your mindset since having an estate plan early on will ensure your retirement years will be hassle-free. Remember that proper estate planning will go a long way in protecting and growing the wealth you have accumulated over the years.

Although circumstances will vary for each individual, there are several general considerations when planning for retirement to cater to all your needs while securing your family’s future during your retirement years. Here are several estate planning tips to keep in mind.

1 – Give Importance To Life Insurance

A crucial consideration when securing your retirement is to prioritize life insurance early on. Life insurance will always be necessary since it offers financial preparedness and peace of mind if an unforeseen event happens. However, it can also be considered a crucial component of your estate planning to ensure a financially secure retirement.

Generally, life insurance provides your beneficiaries with funds without additional taxes while also serving as replacement income for family members who depend on you financially.

2 – Scrutinize Your Expenses

Looking closely at your income and expenses may provide insight into what you’ll have during your retirement years. Although the retirement vision varies for each individual, you must secure your finances early on.

It’d be best to envision what you want your retirement to be so you can prepare. Although various circumstances might come and go, you have an idea of what you want to achieve. If your current lifestyle is beyond your means, it may be best to hold back.

3 – Switch To A Roth Individual Retirement Account (IRA)

As for your retirement account, consider converting your traditional Individual Retirement Account (IRA) into a Roth IRA. If you’re familiar with the difference between the two, a Roth IRA involves paying taxed contributions right away and enjoying tax-free withdrawals in the future. As for traditional IRAs, contributions are deducted with taxes paid on the withdrawals you make later.

Doing so will ensure you’ll pass funds to your beneficiaries without taxes. In most cases, the converted amount will be subject to regular taxes, but any withdrawals you make or by your inheritors will no longer include taxes. The best approach is to pay the taxes on the money now rather than later.

4 – Take Disability Into Consideration

During estate planning, the estate plan should include several crucial considerations if you end up disabled. There are several legal documents you need to prepare, such as a living will, an advance health care directive, and a power of attorney.

A living will outline your end-of-life care wishes where you can indicate any medical treatments, medications, or procedures you want or don’t want to receive. If you overlook one, you might end up undergoing medical measures that you wouldn’t have wanted in the first place.

An advance health care directive addresses your specific wants for your medical care and allows you to assign someone to make health-related decisions once you’re no longer capable. A living will and an advanced health care directive seem strikingly similar. The difference between the two will depend on the state you reside in and how the state defines both terms.

A power of attorney appoints an individual you trust to make financial decisions for you. The chosen individual will take charge of your finances if you become incapacitated. Make sure the person you assign is someone you truly trust to manage your finances properly.

5 – Draft A Will

Drafting a will should be a priority during estate planning. Generally, the document outlines the distribution of your assets in case you pass away.

If you fail to create a will, it’s likely for your estate to be divided during probate. In such circumstances, there’s a high chance that what you wanted for your estate won’t happen. However, even with a will on hand, it’ll still go through the probate process.

Even if you already have a will, make sure to thoroughly review your list of beneficiaries after major events such as the death of a family member, birth of children, divorce, or marriage. Additionally, keep your beneficiaries up to date with your estate plan to avoid possible conflicts in the future.

6 – Consider Setting Up A Trust

One way to ensure you can retain money in your family is to set up a trust. Having one ensures that money will move from one generation to the next, and the best aspect is that it’s protected from lawsuits, divorces, or potential claims from creditors.

In the simplest form, a trust allows you to assign a trustee to oversee your finances according to your specified instructions. A well-structured trust will assure you that your wishes will push through the way you want. Consider employing the services of a lawyer specializing in estate planning and trusts.

Final Thoughts

Although the estate planning process can be challenging for many due to the constantly changing regulations and tax laws, not taking action might not bring the ideal retirement years you’ve envisioned. Even if you consider yourself financially secure, proper estate planning is necessary even before retirement. Considering these valuable insights will give you a head start in keeping your family secure and ensuring hassle-free retirement.

Shared from Lawyer-Monthly.com

Reposted from @ricdarunner I’m super excited to announce our new partnership with The City of Fairburn!! I would like to thank @cityoffairburnga @fairburnparksrec Chapin Scott, Parks and Recreation Director, Jade Berry, Parks and Recreation Supervisor, @marioaveryformayor, @tmarc28, @hattie4fairburn , @ljdavis29 , Hiram Alex Heath, Pat Pallend, Ulysses Smallwood and James Whitmore. This would not be possible without the support of the Fulton County Commissioners and the Department of Arts & Culture. @musicedgroup @davidmanueliam @marvinarringtonjr @nataliewhall @chairrobbpitts @lizhausmann @bobellis333 @commissionerkhadijah and Lee Morris